Codie Sanchez – Main Street Accelerator

Main Street Accelerator

Main Street Accelerator BY Codie Sanchez

Codie Sanchez – Main Street Accelerator Download

Acquire Cash-Flowing Local Businesses — Step-by-Step

Codie Sanchez – Main Street Accelerator is the ultimate roadmap for anyone ready to stop renting their time and start owning real, cash-flowing businesses.

Codie—an ex–Wall Street investor turned Main Street millionaire—shows you exactly how to buy profitable small businesses that pay you from day one. This isn’t startup theory or flashy hype; it’s a practical, proven playbook used by real owners who build wealth through boring, predictable businesses.

Own a Business, Own Your Future

The truth? The next decade will see a $10 trillion wealth transfer as baby boomers retire and sell their businesses. These companies are already profitable—and you can buy them using creative deal structures that don’t require huge upfront capital.

Codie’s program reveals how to find, evaluate, finance, and close these deals like a professional, even if you’ve never bought a business before.

Forget the startup myth.

Forget betting the house.

Forget needing to be “rich enough” to start.

In Main Street Accelerator, you’ll learn how to buy income streams, not jobs—and finally own something that pays you every month.

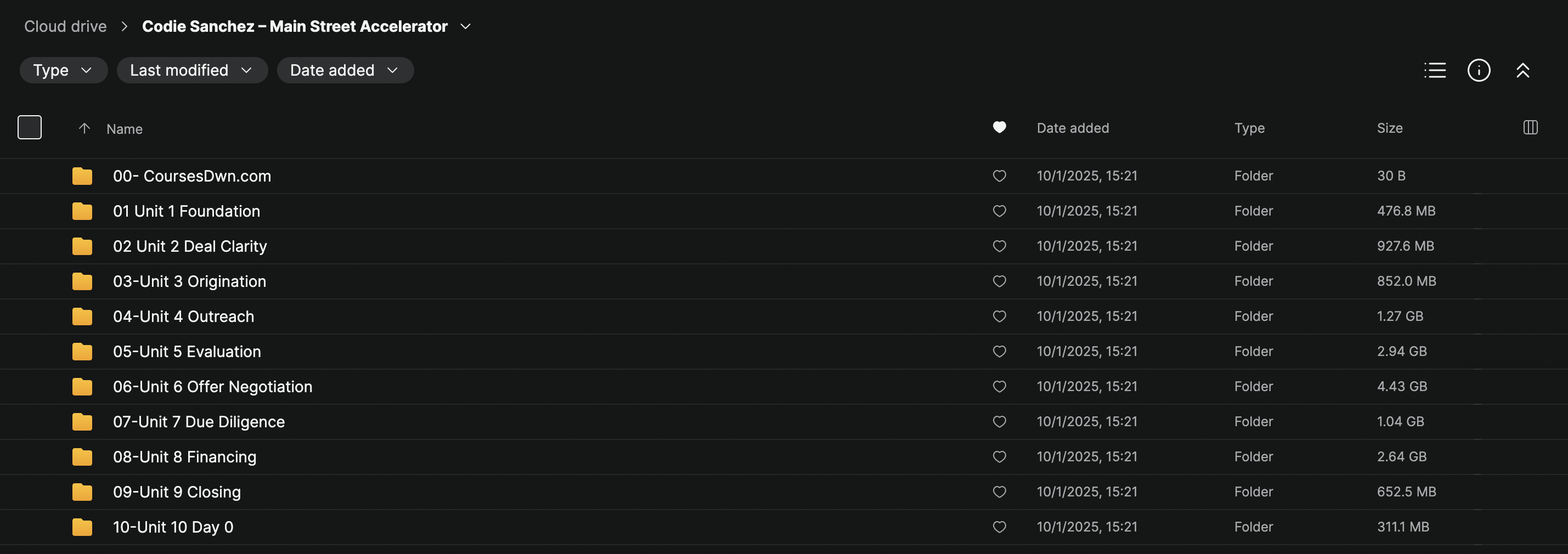

Codie Sanchez – Main Street Accelerator Course

A step-by-step guide through the entire acquisition process from deal sourcing to financing to closing.

This self-paced course includes dozens of video lessons, 32 proprietary templates, scripts, spreadsheets, checklists, sample documents, financing strategies and more.

01. Target the Best Business For You

Get clear on your unique skillsets, business criteria, and income goals to find the best on-market or off-market deals for you.

02. Figure Out What It’s Worth

Learn how to analyze any potential acquisition from start to finish. Determine the right purchase price based on 10 different business value markers.

03. Don’t Skimp on Due Diligence

Dig into the dirty details, ask the right questions, and avoid the landmines. Do NOT sign on the dotted line until you’ve checked every box.

04. Learn Creative Financing

Discover 21 creative ways to finance your deal including seller financing, SBA loans, and sweat equity – without risking your family’s future.

05. Negotiate Like a Pro & Make an Offer

Negotiate and structure the best deal using our proven templates and scripts. Create compelling offers and win-win outcomes for both you and the current business owner.

06. Get the Deal Across the Line & Close

Half of all deals never close because shit goes sideways. Follow this detailed checklist to get YOUR deal across the finish line.

The Course Outline

Unit 1: Foundation

Learn the foundational mindset and knowledge needed to successfully buy a business, including the deal lifecycle and what it takes to run a company.

- Why acquisition entrepreneurship?

- The 10 Acquisition Entrepreneur Mindset Pillars

- The deal journey & lifecycle

- Do you have what it takes to run a business?

- Resource: Action Steps Checklist

- Resource: Acquisition Journey Reference Sheet

- Resource: Acquisition Self-Reflection Worksheet

Unit 2: Deal Clarity

Gain clarity on your personal acquisition criteria using the Contrarian Deal Clarity Framework, focusing on income goals, skills, and target industries.

- Get clarity on why you want to own a business

- Characteristics of the business you should buy

- Which industries you should target

- Create your own Deal Box to find your ideal business

- Resource: Zone of Genius Worksheet

- Resource: Deal Clarity Worksheet

- Resource: Industries Database Selector

- Resource: Personalized Deal Box

Unit 3: Origination

Discover techniques for finding on-market and off-market deals that fit your criteria, and learn to track deal flow using the Contrarian CRM Database

- How deal sourcing works: finding businesses to buy

- Finding deals through marketplaces like BizBuySell

- How to find off-market deals

- 7 other methods for finding off-market deals

- How to track if you’re making progress in business buying

- Resource: Business Sourcing List

- Resource: Business Broker List

- Resource: Deal Sourcing CRM

Unit 4: Outreach

Master the art of positioning yourself as a qualified buyer, engaging sellers, and building relationships with owners and brokers.

- How to position yourself as a qualified buyer

- How to engage with sellers (including scripts)

- FROG Method for meeting sellers

- How to get responses from on-market deals

- Bonus: 3 methodologies for seller outreach

- Resource: Buyer Profile PDF

- Resource: Cold Email Outreach Scripts

- Resource: Questions To Ask Sellers

Unit 5: Evaluation

Learn to evaluate potential deals, sign NDAs, assess valuation using cash flow and market comparables, and decide whether to make an offer.

- How to assess valuation before submitting an offer

- 2 methods for assessing valuation

- How to calculate SDE

- The 10 Contrarian Business Value Markers Framework

- How to quickly crunch the numbers on a deal with our deal calculator

- Resource: NDA Template

- Resource: Deal Decision Tree

- Resource: Contrarian Deal Navigator

- Resource: Deal Calculator

- Resource: SDE Calculation

- Resource: 10 Contrarian Acquisition Value Markers

Unit 6: Offer & Negotiation

Understand the differences between LOIs and purchase agreements, structure creative deals, make offers, handle counteroffers, and negotiate win-win outcomes.

- How & when to use professionals at the offer stage

- What to include in your LOI (with templates!)

- When to use LOI vs APA

- What money is at risk during this stage

- How to present your offer

- How to negotiate your offer with sellers

- Resource: Offer Checklist

- Resource: LOI Template (advanced)

- Resource: LOI Template (simple)

- Resource: Asset Purchase Agreement Template

Unit 7: Due Diligence

Navigate the due diligence process, build your deal team, evaluate key information, and identify potential issues or red flags.

- How to perform due diligence

- How to build your deal team to verify due diligence

- When to use LOI vs APA

- What information to look for during due diligence

- How to present your offer

- How to negotiate your offer with sellers

- Resource: 60+ item due diligence checklist

Unit 8: Financing

Explore the five main acquisition funding methods and 21 specific financing strategies, including seller financing, SBA loans, and sweat equity.

- Learn the main ways deals are financed

- How & when you should leverage debt to finance your deal

- How to combine debt & equity

- Deep dive into seller financing

- Deep dive into SBA loans

- Deep dive in sweat equity

- Resource: 21 Financing Options Sheet

- Resource: Expertise to Equity Terms Worksheet

- Resource: Seller Financing Avatar Checklist

Unit 9: Closing

Master the formal closing process, resolve outstanding issues, finalize legal documents, and understand escrow and purchase price allocation.

- Learn how the closing process works

- How does escrow work during closing

- Who are the key people involved in closing?

- Models: Services, products and systems

- Buying franchises with Wayne Lucier

- Resource: Closing checklist

Unit 10: Day Zero

Prepare for the transition to ownership by completing essential tasks and setting the stage for a successful first day.

- What do you do on day 0

- How do you prepare to operate the business

- Resource: Day zero checklist

- Resource: Working capital needs

What You Get Inside

- 10 comprehensive learning units

- Dozens of video lessons with real-world examples

- 32 proprietary templates, scripts, and spreadsheets

- Financing and negotiation strategies from real M&A deals

- Lifetime access to course updates

- Access to Contrarian Thinking’s private network of dealmakers

Who This Course Is For

✅ Employees tired of 9–5 who want financial freedom

✅ Investors seeking cash-flowing assets

✅ Entrepreneurs ready to expand through acquisitions

✅ Anyone who wants to learn real business buying—not theory

Whether it’s your first acquisition or your tenth, Main Street Accelerator gives you the frameworks, tools, and confidence to close profitable deals without risking everything.

Why Learn from Codie Sanchez

Codie has personally acquired over 23 profitable Main Street businesses after years in high finance.

She’s distilled her 10,000+ hours of M&A experience into this program—so you don’t have to learn the hard way.

Her Contrarian Thinking community has helped thousands of everyday people escape corporate life and step into ownership.

Final Thoughts

This isn’t about “get rich quick.”

It’s about owning real businesses, earning real income, and building long-term freedom through smart acquisitions.

Download Codie Sanchez – Main Street Accelerator.

Sale Page : https://contrarianthinking.co/main-street-accelerator/