Matt Began – Bank Financing and Unsecured Lines Of Credit

Bank Financing and Unsecured Lines Of Credit

Bank Financing and Unsecured Lines Of Credit BY Matt Began

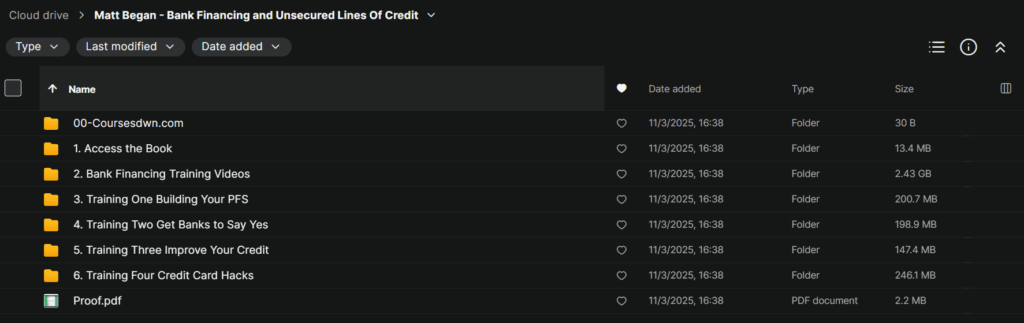

Matt Began – Bank Financing and Unsecured Lines of Credit Download

Unlock Capital the Smart Way

If you’ve ever dreamed of funding your business or real estate investments without draining your savings or giving up equity, Matt Began – Bank Financing and Unsecured Lines Of Credit is your roadmap to financial freedom. This course breaks down the proven strategies behind securing bank loans, credit lines, and large-scale funding—using Other People’s Money (OPM) the smart way.

Created by seasoned investor Matt Began, this program teaches you how to unlock reliable, flexible capital through a blend of bank financing and unsecured credit lines. Whether you’re a startup founder, small business owner, or property investor, you’ll learn how to access funding fast, manage it wisely, and scale without risking your assets.

What You’ll Learn in Bank Financing and Unsecured Lines Of Credit

Matt Began’s financing system is built on a simple but powerful principle: leverage money strategically, not desperately. Instead of waiting for investors or maxing out personal cards, you’ll learn how to create a sustainable capital ecosystem that grows with your business.

Here’s what the course covers in depth:

- Understanding Bank Financing – Learn how business and personal loans work, how banks assess risk, and how to structure your finances for faster approval.

- Mastering Unsecured Lines of Credit – Discover how to access revolving credit accounts with no collateral and flexible repayment terms.

- Credit Profile Optimization – Build and repair your credit for top-tier funding opportunities.

- Strategic Bank Pairing – Match your profile with the right lenders for higher approval odds.

- Diversification Tactics – Spread funding across multiple institutions to minimize risk and increase available capital.

- Business Credit Scaling – Learn how to grow from personal credit to full business financing under your company name.

Each step of the program is designed to help you create a sustainable, scalable funding strategy—so you can move faster, grow smarter, and keep your equity intact.

Why This Course Stands Out

While most financing programs focus on theory, Bank Financing and Unsecured Lines Of Credit gives you actionable systems built from real-world experience. Matt Began has personally secured over 2,000 bank loans, acquired 450+ properties, and raised millions in unsecured capital.

You’ll get his blueprint for accessing cash fast—even if you’ve been rejected before.

The Benefits You’ll Gain

- No Collateral Required – Secure funding without risking your house, car, or assets.

- Fast Approvals – Access capital within days, not months.

- Build Long-Term Credit Strength – Turn borrowed funds into a credit-building strategy for your future.

- Diversify Capital Sources – Mix loans, credit lines, and cards for ultimate flexibility.

- Maintain Ownership – Keep full control of your company while still getting the funds you need.

This combination of bank financing and unsecured lines of credit gives you the agility to act quickly on new opportunities—without waiting for investors or loan committees.

Who This Course Is For

This program is perfect for:

- Entrepreneurs & Startups who need fast working capital

- Real Estate Investors funding deals or renovations

- E-commerce Businesses managing inventory cycles

- Consultants & Agencies bridging gaps between client payments

- Small Business Owners wanting steady cash flow through any season

No matter your industry, mastering capital access means you can operate from financial strength instead of financial stress.

Smart Borrowing and Risk Management

Matt Began’s strategy isn’t about reckless borrowing—it’s about responsible leverage. Inside the course, you’ll learn how to:

- Borrow within your limits and manage credit utilization smartly.

- Track your lines of credit through modern dashboards.

- Avoid over-leverage while keeping credit scores strong.

- Grow your access to capital safely over time.

The result? You’ll never feel at the mercy of lenders again—you’ll control the system.

Building Your Financial Future

By combining unsecured lines, term loans, and vendor credit, you can create a personalized financing structure that grows alongside your goals. This hybrid model brings:

- Stronger relationships with multiple banks

- Higher credit limits over time

- Better loan terms through proven credit history

- Long-term financial independence

Matt Began’s method empowers entrepreneurs to think like investors—using funding as a tool for growth, not a burden of debt.

The Future of Smart Financing

In today’s fast-paced economy, credit-based leverage is the new competitive advantage. Fintech lenders and credit unions are reshaping access to funding. By mastering Matt Began’s approach, you’ll stand at the forefront of this shift—ready to scale your business faster, safer, and smarter than your competitors.

About the Instructor: Matt Began

Matt Began started from humble beginnings in Illinois, working long hours in a machine shop and struggling to make ends meet.

Driven by frustration and financial limitation, he turned to real estate and spent years learning every aspect of banking and credit.

Since closing his first wholesale deal in 2006, Matt has:

- Completed thousands of real estate transactions

- Conducted over $85 million in deals in the past 3 years

- Built a portfolio of hundreds of cash-flowing rental properties

- Secured funding from over 2,000 banks and credit institutions

Today, he teaches entrepreneurs and investors how to use the same system to achieve financial independence and long-term wealth.

Conclusion

Financial freedom doesn’t come from luck—it comes from strategy. Matt Began – Bank Financing and Unsecured Lines Of Credit gives you the playbook to secure funding, manage risk, and grow your business with confidence.

Stop relying on limited savings or investors who take a cut of your success. Learn how to leverage the financial system in your favor—and unlock the capital to build the business and lifestyle you deserve.

Download Bank Financing and Unsecured Lines Of Credit by Matt Began.

Sale Page : https://www.nber.org/system/files/working_papers/w28029/w28029.pdf