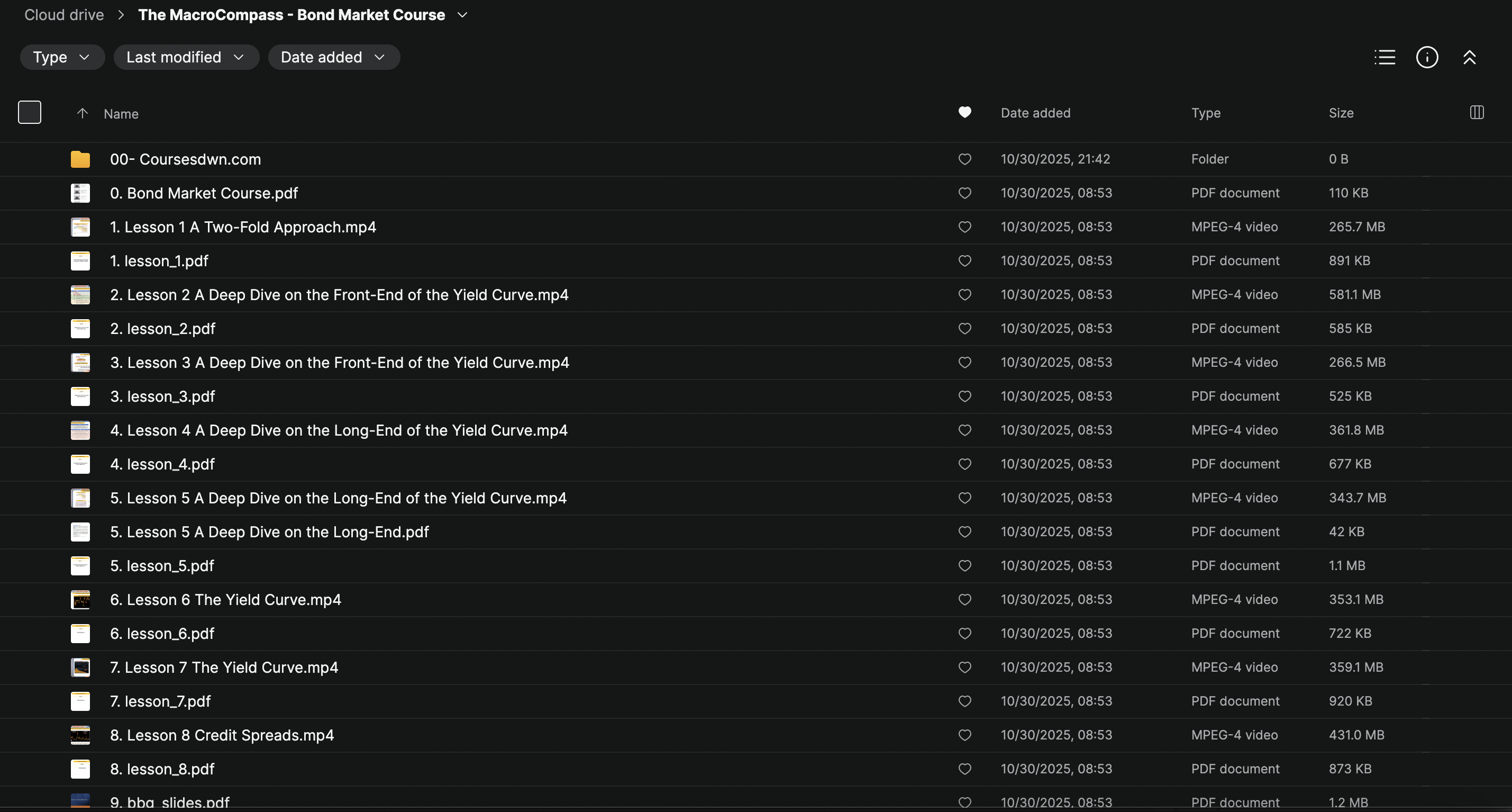

The MacroCompass – Bond Market Course

Bond Market Course By The MacroCompass

The MacroCompass – Bond Market Course Free Download

The MacroCompass – Bond Market Course Download

Master the Bond Market and Decode the Global Economy

The MacroCompass – Bond Market Course by Alf Peccatiello is a practical, deep-dive training for investors who want to understand the bond market—the true foundation of global macro investing.

If you’re serious about building a macro framework, this course will change the way you see markets. Alf simplifies complex financial concepts into clear, actionable insights you can use immediately to make smarter investment decisions.

What You’ll Learn

Master the Bond Market from the Inside Out

The bond market can seem intimidating—full of jargon, insider terms, and institutional strategies—but this course breaks everything down step-by-step. You’ll learn how bonds really work, how to analyze them, and how they drive everything from interest rates to asset prices across global markets.

You’ll discover:

- How to read and interpret bond yields, curves, and spreads

- The relationship between inflation, interest rates, and monetary policy

- How central banks, liquidity, and macro conditions impact bonds

- The role of bonds in asset allocation and portfolio construction

- Real institutional frameworks used by professional investors

The MacroCompass – Bond Market Course Overview

Lesson 1: ”Liquidity”, The First Tier of Money

You must have heard the word ”liquidity” thousands of time: but what is it? In these two lessons we analyse Central Bank balance sheets, define liquidity, who prints it, how does it work, and its impact on markets and the economy!

Lesson 2: ”Real-Economy Money”, The Second Tier of Money

Money printing generates inflation, right? Yes – but who prints inflationary, real-economy money? Lesson 2 will walk you through the process of real-economy money printing: who prints it, how, and what are the macro consequences and market impact of different forms of inflationary money printing.

Lesson 3: “Monetary Plumbing”

You know all these monetary plumbing operations you often hear about without never fully understanding their mechanics? Reverse Repo, Treasury General Account, Bank Term Funding Program? This ends today with lesson 3, where we proceed with a deep dive into all monetary plumbing operations so that you never have to scratch your head again when you hear them.

Course Recap

A quick recap where Alf summarizes the most important concepts you learnt in the TMC Monetary Mechanics Course.

Why Learn with Alf Peccatiello?

Alf is a former institutional investor and portfolio manager, known for his ability to make complex macro and monetary topics simple. Through The MacroCompass, he has helped thousands of investors understand how liquidity, monetary policy, and the bond market shape global investing.

He brings the clarity of real-world experience—transforming abstract financial concepts into practical tools.

Bonus: The MacroCompass Course Collection

After completing the Bond Market Course, you can continue with The Monetary Mechanics Course, where Alf explains the deeper “plumbing” of modern finance: fiscal deficits, QE, QT, the Treasury General Account, and Reverse Repo operations.

Together, these courses build a full picture of how money flows through the economy—and how to position yourself ahead of market cycles.

Learner Testimonials

“Alf’s passion for macro investing is contagious. He makes complex concepts simple and actionable.”

— Ferdinand B.

“Mastering monetary mechanics and bonds is crucial for every macro investor. Alf’s courses are the best way to learn.”

— Alexander K.

“The clarity, structure, and practicality of this course are unmatched. I finally understand how the bond market really moves.”

— Thomas O.

Course Highlights

- 4+ hours of expert instruction

- Step-by-step bond market analysis

- Real-world case studies & examples

- Supporting slides and data resources

- Direct insights from a professional macro investor

Final Thoughts

If you want to stop guessing where markets are headed and start understanding why they move, this course is your roadmap.

The MacroCompass – Bond Market Course gives you the analytical tools to read interest rate signals, assess economic trends, and make confident investment calls in any market environment.

Download The MacroCompass – Bond Market Course.

Sale Page : https://themacrocompass.org/courses/